“Alright, kiddos, we’re changing the structure of your allowances.” I leaned forward on the couch with my elbows on my knees. My hands were clasped, and I opened them to say, “You get a raise with the new year” – our children bounced and clapped their hands – “BUT with the condition that you put a portion away for long term savings, and you put a portion aside for charity.”

—-

My husband and I discussed the kid’s allowance for weeks as we worked on our own budget. After ten years of supporting a family of four on one income (an income which consisted of student loans, part time graduate teaching assistantships, and when we hit the big time, a post-doctoral stipend), we are behind on savings: retirement savings, college savings, orthodontic savings. Emergency savings for car repairs and those surprise bills that always seem to arrive when you finally think you’ve got your finances under control.

Over the past year and a half we have worked to catch up on paying off debts, and now its time to start carving money out of my husband’s checks to build up a savings buffer. And though every cent of our income was already accounted for – groceries, gas, clothing, sports – we wanted to build charitable giving in as well. Using our new budgeting software*, You Need a Budget (YNAB), we cut a little here, arranged a little there, reduced our family entertainment budget, and created a little pile for charities we feel strongly about supporting.

“Most of the financial stuff I read recommends setting aside 10% of your income for long term savings,” my husband told me. He dunked his tea bag as he ran numbers in his head. “We’re doing well with that through the University’s retirement plan.”

“Okay,” I said, “we can set that same goal for the kids: 10% of their allowance towards long term savings – savings they can’t touch til they are 16 or something.” I remembered my savings account, the one my Grandmother encouraged by matching contributions to it. I adored getting my statement in the mail and seeing tens of dollars turn to hundreds. I don’t remember what I ultimately used the money for, but I loved the safe feeling that savings account gave me.

“That’s going to suck for them to watch their allowance go down,” my husband said. His eyebrows worked together, wrinkling his forehead as he worried for the kids. “It’s already hard enough for them to save up for something they want.”

“Well, that’s pretty much how it works for us too,” I said. “We think we have all this money, then we budget it out and there’s barely enough to go to a movie.”

“But they get so little.” Our son saved allowance for ten months to buy a Wii U. His resolve to save was inspiring; he opted every allowance cycle to put money in his bank account instead of getting paid in cash. For almost an entire year. It seemed wrong to shrink his income when it already took so long to save for short term purchases.

“What about charity?” I asked. “What are the recommendations for that?”

“It’s kind of all over the place,” my husband said. Suggestions range anywhere from 2.5% of income to 10% of income or 1% of net worth, whichever is greater.

“How about we suggest 5% to the kids?” I ran calculations in my head and realized even at that rate their total annual contribution would be less than $10. I sighed. “Anything less and it will barely be pennies,” I said.

“I don’t know. This could be a hard sell.”

Our previous allowance model gave them the option of $5 in cash or $6 in their bank account to encourage saving. “Well, I’ve budgeted their allowance at $6 apiece,” I said. “We could up their allowance to $6 so it won’t be such a hard transition for them. Their pocket money would end up being the same.”

“That works for softening the blow to their wallets, but it doesn’t leave much for their savings accounts or donations,” my husband said. We both worked numbers in our head and realized that at this savings rate, by the time our son turns 16, he will have only saved about $200. That won’t do much for buying a car. My husband sighed. “I guess the point is to get them in the habit.”

“Maybe we can offer matching like my Grandma did for me. If someone gifts them money, we could match whatever portion they choose to put into savings.” Now my forehead was the wrinkled one as I tried to figure out where that money would come from.

—–

“What’s charity?” our daughter asked. She’s eight.

“Well, it’s when you donate some of your money to someone in need, or to a place that isn’t in the business of making money, but is in the business of providing a service that isn’t focused on profiting but on spreading awareness, or culture, or sharing art.” Our ten-year-old son cocked his head at me. He didn’t know what I meant.

“You know that radio station Daddy and I always listen to? The one with the funny Car Talk guys?” They both nodded. “That’s called public radio; they don’t sell advertising, and the only way they can provide their service is if people donate money to them.”

“Oooooh,” our son said.

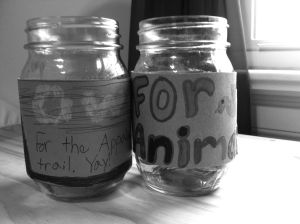

“So that’s one of the places Daddy and I donate money.” I stood up and told them to hang on a second. I trotted downstairs to the storage shelves in the basement and pulled two Ball jars off the wooden slat. I cut a rectangle of paper to a length and width that would wrap around the jar and carried the three components upstairs.

I set the jars on the coffee table and asked the kids, “Is there anything you feel really strongly about donating money to? There are a million causes you could support: libraries, the arts, giving books to people who don’t have access to them, animals -”

“OOOHH! Animals!” Our daughter jumped up and down. I gave her the rectangle of paper as a template to cut a label for her charity jar.

“You can decorate it however you want, and when you get your allowance, you will put your 5% for charity in the jar,” I said. I turned to our son. “What about you, buddy?” He didn’t seem moved by additional suggestions I gave. “Do you have anything you feel strongly about supporting?” He looked at the floor and didn’t answer.

“Oh, I have an idea,” I said. “Daddy is giving some of his personal allowance money to help keep the Appalachian Trail maintained and protected. Do you think you’d like to support that too?” Besides soccer, our son’s favorite activity is hiking. He loves nature and waxes philosophical when we are out on the trail.

His eyes got big and he shook his head up and down and smiled. He grabbed his jar and ran upstairs. “Wait! Your change!” I counted out quarters and nickels from the rolls my husband picked up at the bank and jogged them up to our kids’ rooms.

A few minutes later both kids trampled down the stairs to show me their jars.

“But these have dollar bills in them,” I said. “I only gave you change.”

“I know,” our son said. “I wanted to give some more.”

“Me too,” said our daughter. “For the animals.”

This is my entry for the Weekly Photo Challenge: Beginning.